BDR - Brazilian Depositary Receipt

Offer global investments

BDRs are certificates of deposit of securities issued in Brazil. In the case of Non-Sponsored Level I BDRs, the certificates are related to a publicly-held company, or similar, with head office abroad, and are issued by a depository institution in Brazil.

Main characteristics

Find more about BDRs

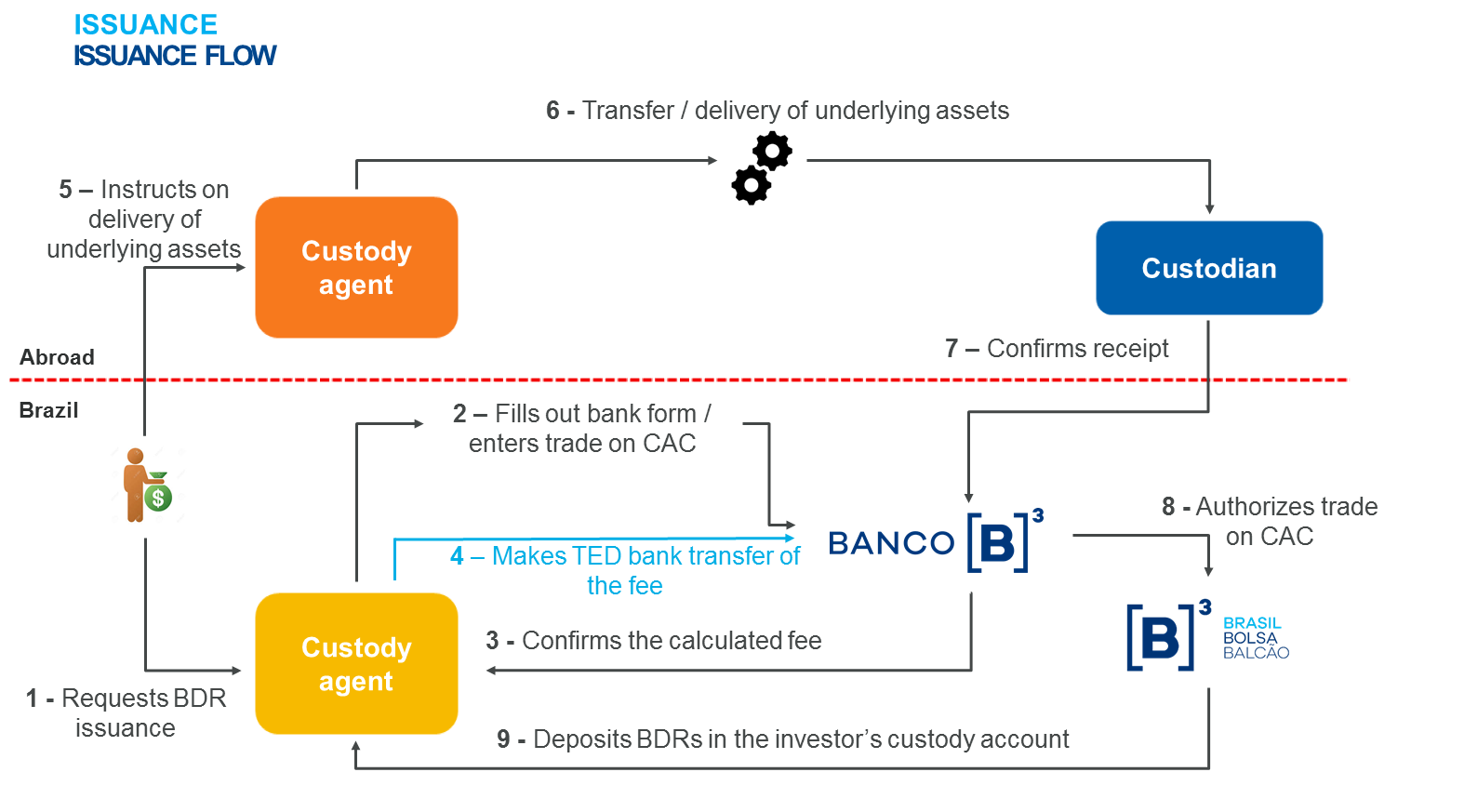

Issuance and cancellation

Fixed fee USD 15.00 plus the incremental fee over the financial value of each operation.

Financial Value: BDR Quantity multiplied by the closing price of the last trading session of the BDR or Underlying Asset (whichever is the most recent, with the price of the BDR being the priority and respecting the parity of the program); the total financial value of the operation will be divided among the bands listed in the table below applying the respective percentage:

Between

R$0,00 e R$1.000.000,00

Percentage Rate 0,10%

Between

R$1.000.000,01 e R$2.500.000,00

Percentage Rate 0,08%

Between

R$2.500.000,01 e R$5.000.000,00

Percentage Rate 0,06%

Between

R$5.000.000,01 e R$10.000.000,00

Percentage Rate 0,04%

Above

R$10.000.000,00

Percentage Rate 0,02%

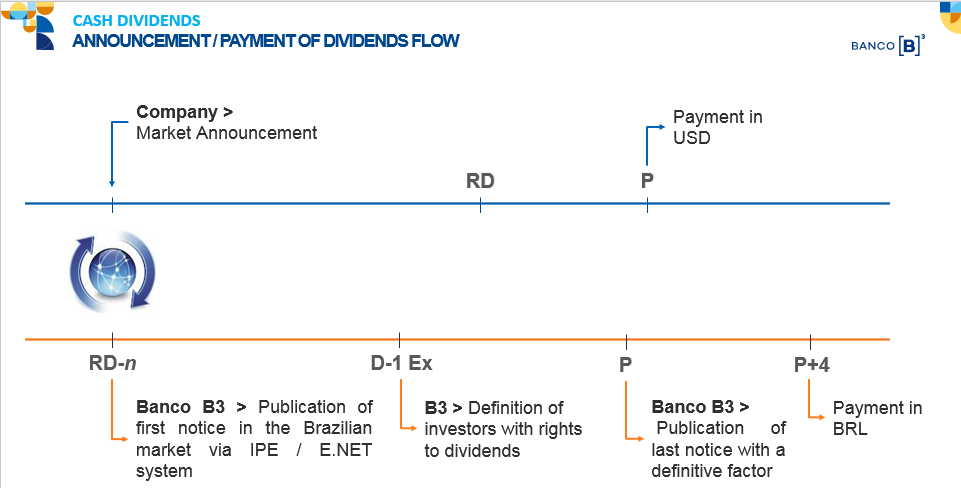

Cash dividends

Exchange rate closed at payment cycle and notified to the market via IPE system.

Account for payment of fees and charges:

CNPJ: 00.997.185/0001-50

Bank No. 096. Branch 001. Accoun No. 2734-2

Time Limit: 3:00 p.m. (Brasília time)

Issuance instructions

Fill out the request form from Banco B3;

Solicitar confirmação da taxa por parte do Banco;

Free of Payment

DTC: 908 / Account: 250280

Further credit to: [B3 user number and name local custody agent]

B3 code: [B3 code and name of the investor]

Local Custody Agent contact name and phone number:

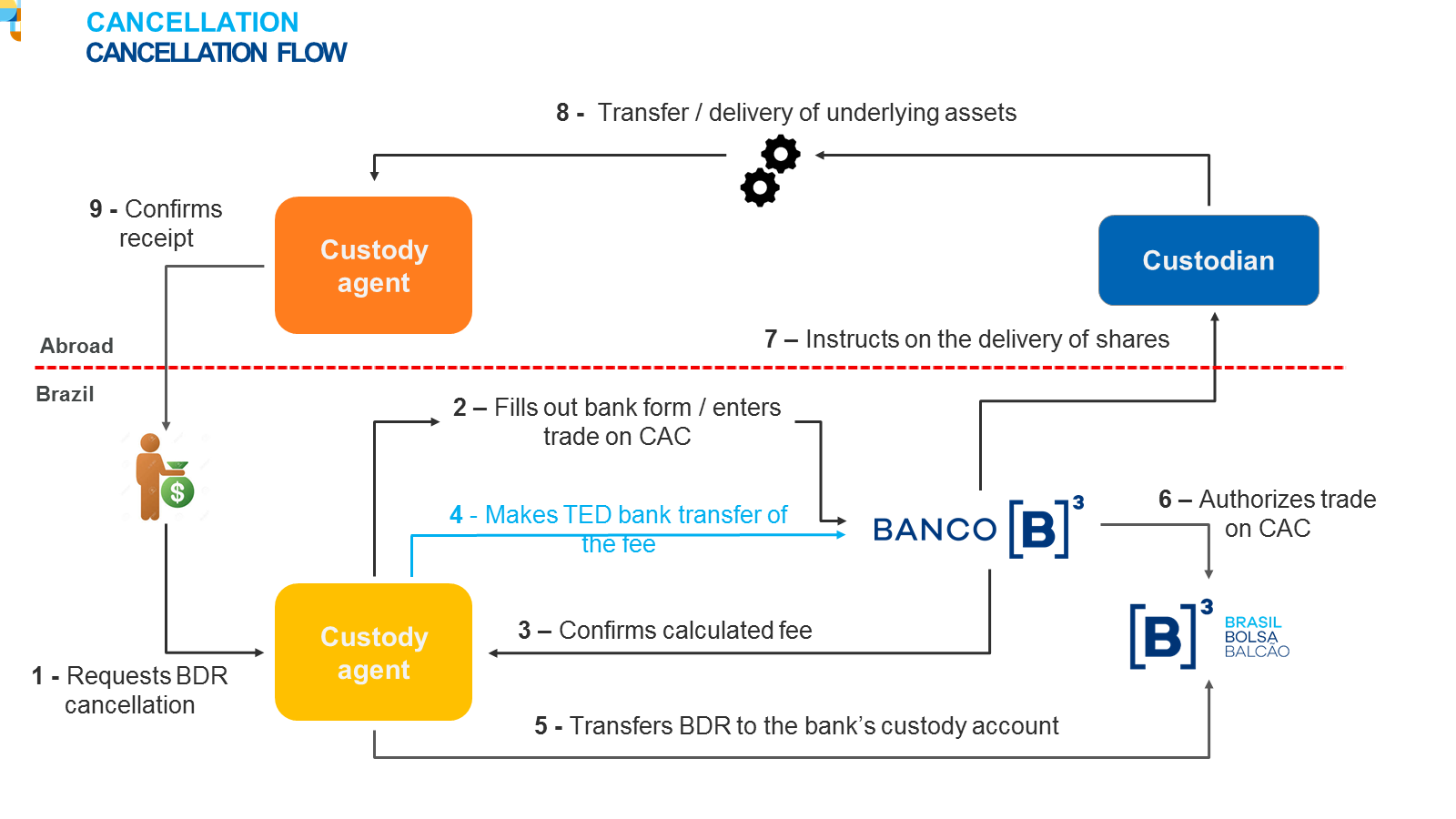

Cancellation instructions

Fill out the request form from Banco B3;

Request confirmation of the fee from Banco B3.

Delivery of BDRs:

Usuário do Emissor na B3: 2967-0

Conta do Emissor: 10.300-9

Carteira: 2101-6

Times

Regular Time

5:00 p.m

SP time

4:00 p.m

NY time

Summer Daylight

5:00 p.m

SP time

3:00 p.m

NY time

Contacts

Trades

issuance, cancellation and corporate actions

Phone: 2565-4431 / 6218 / 6217 / 6228

E-mail:

[email protected]Sales and products

Phone: 2565-5784

E-mail:

[email protected]CVM Instruction 182/2023

Provides for the issuance and trading of Brazilian Depositary Receipts - BDRs guaranteed by securities issued by publicly held companies, or similar, based abroad.

CVM Instruction 80/2022

Provides for the registration of issuers of securities admitted to trading on regulated securities markets.

CVM Instruction 13/2020

Provides for the registration, trades and disclosure of information of non-resident investors in Brazil.

B3 Issuer’s Manual

Establishes and consolidates complementary procedures and technical and operational criteria to the Regulation for Listing of Issuers and Admission to Trading Securities.